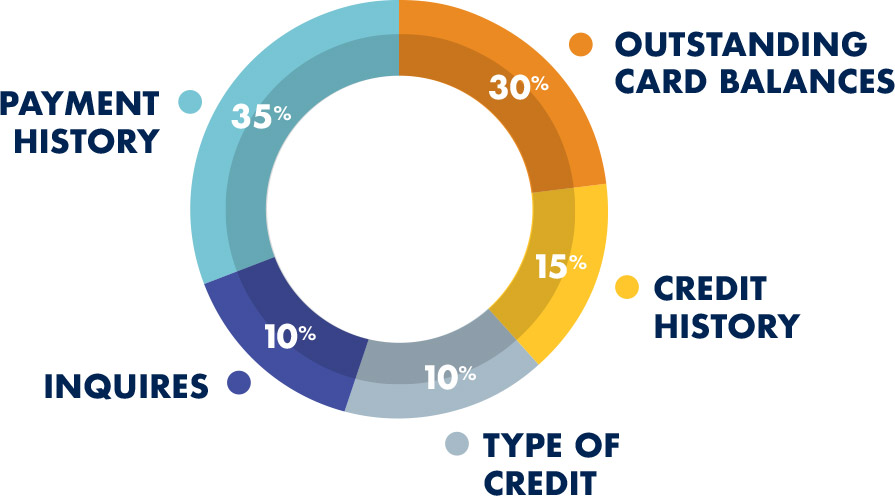

Five Elements That Make Up Your Credit Score

Credit scores are comprised of five factors. Points are awarded for each component, and a high score is most favorable. Here’s the breakdown of what makes up your score.

PAYMENT HISTORY – 35% IMPACT

Paying off debts on time has the greatest positive impact on your credit score. Late payments, judgments and chargeoffs all have a negative impact. Delinquencies that have occurred in the lost two years carry more weight than older items.

OUTSTANDING CREDIT CARD BALANCES – 30% IMPACT

This factor marks the ratio between the amount owed and the remaining available credit. Ideally, the consumer should make on effort to keep balances as close to zero as possible, and definitely below 30 percent of the available credit limit.

CREDIT HISTORY – 15% IMPACT

This portion of the credit score indicates the length of time since a particular credit line was established. A seasoned borrower will always be stronger in this area.

TYPE OF CREDIT – 10% IMPACT

A mix of credit, such as on auto loan and a credit card, is more positive than a concentration of debt from only credit cards.

INQUIRIES – 10% IMPACT

This percentage of the credit score quantifies the number of inquiries made on a consumer’s credit within a twelve month period. Each new credit inquiry can deduct points from a credit score. Note that personal credit inquiries do not impact scores.

The Do’s And Don’ts When It Comes To Rebuilding Your Credit

3 MONTHS PRIOR TO SECURING YOUR MORTGAGE

3 MONTHS PRIOR TO SECURING YOUR MORTGAGE

Do NOT apply for, close or pay off any collections, charge-offs, loans or other kinds of credit without speaking to your mortgage professional first.

CREDIT CARDS WITH EXCELLENT HISTORY

Do you have credit cards with excellent credit? Use them strategically! Keep your balances below 30% of their limits for 3-6 months before entering into a loan transaction. Only use them for small purchases that you are able to pay off every month. This will show creditors that you are stable and in control of your finances.

NO CREDIT?

If you do not have a credit card, do get a secured card immediately. This is a great way to build, rebuild or establish credit quickly. Just make sure to pay your bill on time every month.

CREDIT ACCOUNT CO-SIGNER

For some, opening a credit account with a co-signer could be a better alternative. Just be aware that you AND your co-signer will be responsible for all financial obligations moving forward.

Should I pay off all of my past due balances & charge-offs?

You only need to worry about the last two years. Items over two years old have little effect on your current credit score.

Should I close existing credit card accounts that I dont use?

No! Part of your credit score is based upon credit history. Rather than trying to pay off all of your credit cards, try to keep all credit card balances under 30% of your total limit.

What about errors on my credit report?

If you have items that are showing up on your credit report that you know you have paid, request that they be removed by the credit bureau. They are obligated to rectify this within 30 days.

If there are any items that are less than two years old, send in your payment if possible and mark the back of the check with the following: “accepting this check is evidence that the transaction is complete and this charge will be deleted from my credit record.”