OBTAINING THE LOWEST POSSIBLE RATE

The factors that have to do with securing the lowest possible rate have less to do with scouring ads and more to do with the particulars of your own transaction. When lenders advertise, they will typically pick the best scenario as the basis for their ad (i.e.. Highest credit score, lowest LTV). Unfortunately, that rarely applies to all that are in the market. Unless you took the time to read the disclosures, this can often feel like a bait and switch.

LOAN LEVEL PRICE ADJUSTMENTS (LLPA’S)

The differences between rates are based on LLPA’s or risk factors. If you’re making a smaller down payment or have a low credit score, this is generally perceived to carry higher risk. Lenders or the investors that purchase the Mortgage Backed Securities that most loans are turned into want to be compensated for that. This is achieved through slightly higher rates which translates to a higher yield or rate of return to the investor or lender.

LOAN TYPE MATTERS TOO

Example: An adjustable rate mortgage (ARM) can provide a lower start rate than a fixed rate mortgage. This is because the rate will adjust to match the market over time. In turn, this reduces the risk of money being locked at a low yield if rates rise and in exchange, investors are willing to discount the first year or years of the loan.

SHORT TERM LOANS

Such as 15 years return to the principal lent at a faster pace and that assures the loan value will shrink faster too. This decreases risk and accordingly, provides for a lower rate. Shorter terms carry higher payments and lenders are just as careful in the qualification process with these as they are with any other loan. Lower risk coupled with prudent underwriting = lower rates.

OTHER FACTORS

You can also see that as credit scores improve, the rate differential for LTV changes is less pronounced. Hence, the combination of certain factors can work together to impact your final pricing. Example: For a 5/1 ARM if you have 750+ credit score the rate difference between 70% and 90% LTV is .5% vs. a 679 credit score where the difference is a full 1%. The bottom line becomes one of scenario management and this is where PRMI excels. Reach out anytime and we will work together to help obtain the best and smartest possible financing for you particular situation and needs.

What Are They, How Much Do They Cost And Should I Pay Them?

What is a point and how much do they cost?

Enter points are really called discount points and technically, they are considered to be pre-paid interest. Functionally, they are paid in order to buy a lower interest-rate on your loan. One point equals 1% of the loan amount. Example: one point on a loan of $100,000 equals $1,000.

Should I pay them?

To determine whether it’s worth your while, you divide the upfront cost by the monthly savings to determine the break-even point. If your intention is to own the property be on that time period, you have the initial basis for a decision. Example if $100,000 30-year loan, $1,000 is paid as a point saves you .25% in rate, that equals a savings of $15.17 per month. If we divide $1,000 cost by the $15.17 savings, we calculate that it takes 65.9 months to reach break-even. There is however, more to it than just that.

The rest of the equation

Points can be tax-deductible and the year paid on purchases and over the life of the loan on refinances always consult with your tax professional for advice. This can mean that the real cost can be less than it would shorten the break-even point. Purchase example $1000 paid less 20% tax seduction equals net cost of $720 ÷ $15.17 per month equals break-even point of 47.46 months.

Where is the risk? You have to consider that once points are paid, that money is gone. If you sell or refi before earning it all back, the difference will be a loss.

Alternatives

A smart strategy for conservative borrowers is using the money you would pay as points to add to your down payment. Example borrowing $1000 less at 5% on a 30-year loan will save you $5.37 per month. The savings is not as big as pain points get you don’t have to wait for to six years to benefit. The savings occurs immediately and that money is not paid as a fee, it’s simply parked in your home’s equity to be returned to you upon sale. You can also consider leaving any extra money in the bank. Having cash reserves can sometimes be more valuable than slightly lower payment.

In Conclusion

You can see that there’s more to this one simple equation and unless you know definitively how long you will have your home or your loan, it’s very speculative. The best way to decide is to think about whether you are short term or long term owners and then assess whether you are more comfortable with a lower payment or more cash in hand, in the bank or in your equity. You also have to consider whether you might refinance at some point to pay for improvements, eliminate PMI, take it vantage of a lower rate or shorter term, etc. Each loan option has its own merits and risks.

As always, we’re here to help you with your calculations and decisions and all you ever need to do is reach out at any time.

Two Ways Rising Mortgage Rates Could Impact You

According to the Freddie Mac weekly market survey, mortgage rates have increased by 0.5% in the past year (April 2017 – April 2018). This means your monthly payment today could be approx. $30/month higher than it was last year for every $100,000 you borrow. Here are two ways this could impact you:

According to the Freddie Mac weekly market survey, mortgage rates have increased by 0.5% in the past year (April 2017 – April 2018). This means your monthly payment today could be approx. $30/month higher than it was last year for every $100,000 you borrow. Here are two ways this could impact you:

1. If You’re Thinking of Buying a Home

It may be worthwhile for you to consider buying a home now instead of waiting. That’s because most economists anticipate that interest rates will continue to go up throughout this year due to:

- Risk of higher inflation, which leads to higher interest rates

- A greater supply of bonds due to growing budget deficits

- Less demand for bonds due to the Fed winding down their bond-buying program

It may benefit you to lock in today’s rates instead of waiting for interest rates and monthly payments to move higher.

2. If You’re Thinking of Making Home Improvements

You may be able to fund your new project by using a “cash-out” mortgage refinance. That’s where you trade in your current home loan for a larger home loan, and use the “cash-out” for your new home improvement project. For the same reasons outlined above, it may be worthwhile for you to consider doing this now instead of waiting.

Contact me for more info or to explore your options!

PLEASE NOTE: This article is provided for illustrative purposes only. It is not an offer or commitment to lend you money, and it is not an advertisement for a specific mortgage or a specific interest rate. Payment examples don’t include property taxes and home insurance. Contact me to run the numbers for your situation.

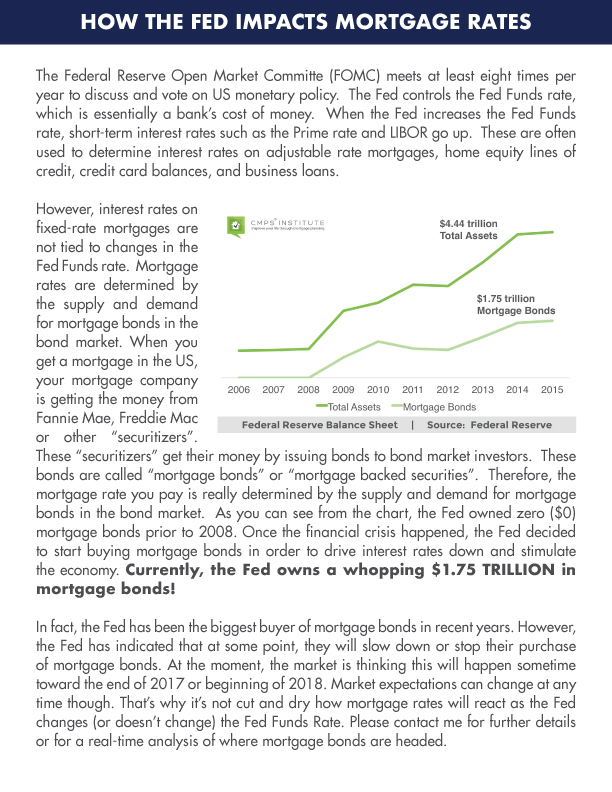

Source: CMPS Institute